Integrating the Commercial Registration Electronic System into Your Company Formation Technique

Integrating the Commercial Registration Electronic System into Your Company Formation Technique

Blog Article

Navigating the Complicated World of Firm Development: Insights and Methods

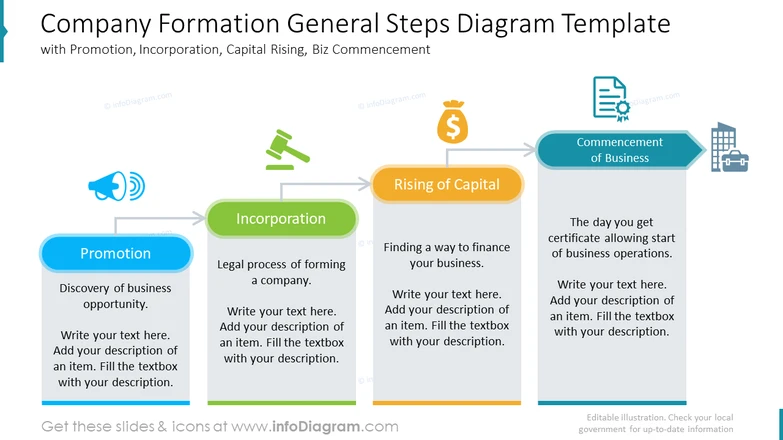

As business owners established out to browse the intricate world of company formation, it becomes essential to equip oneself with a deep understanding of the intricate subtleties that specify the procedure. From choosing the most suitable company structure to making sure stringent legal compliance and creating reliable tax obligation preparation strategies, the path to creating a successful business entity is filled with complexities.

Service Framework Selection

In the world of firm development, the vital decision of choosing the ideal business framework lays the structure for the entity's legal and operational structure. The selection of organization framework dramatically impacts different aspects of the organization, consisting of taxes, responsibility, monitoring control, and conformity demands. Entrepreneurs have to thoroughly assess the available choices, such as sole proprietorship, partnership, limited responsibility firm (LLC), or firm, to figure out one of the most appropriate structure that lines up with their service goals and conditions.

One usual framework is the sole proprietorship, where the proprietor and the organization are considered the exact same lawful entity. Comprehending the subtleties of each organization framework is essential in making a notified choice that establishes a solid groundwork for the business's future success.

Legal Compliance Essentials

With the structure of a suitable organization structure in area, ensuring legal conformity essentials becomes vital for securing the entity's operations and preserving regulative adherence. Legal conformity is crucial for companies to operate within the boundaries of the regulation and prevent lawful concerns or prospective charges.

To guarantee lawful compliance, business must routinely examine and upgrade their policies and procedures to mirror any kind of modifications in guidelines. Looking for legal counsel or compliance specialists can additionally aid companies browse the intricate lawful landscape and stay up to date with evolving laws.

Tax Preparation Factors To Consider

In addition, tax obligation preparation need to encompass strategies to benefit from offered tax deductions, credit ratings, and incentives. By strategically timing income and expenditures, organizations can possibly reduce their gross income and total tax concern. It is also crucial to remain notified about changes in tax obligation legislations that may influence the service, adapting strategies as necessary to continue to be tax-efficient.

Moreover, worldwide tax preparation considerations might develop for companies running across borders, including complexities such as transfer rates and foreign tax credits - company formation. Looking for assistance from tax professionals can aid browse these intricacies and develop an extensive tax strategy tailored to the firm's requirements

Strategic Financial Management

Tactically managing financial resources is a fundamental element of guiding her latest blog a business in the direction of sustainable growth and productivity. Efficient economic management includes a comprehensive technique to looking after a business's financial sources, investments, and general economic health. One crucial component of tactical economic monitoring is budgeting. By creating in-depth spending plans that align with the company's purposes and goals, companies can designate resources effectively and track efficiency versus financial targets.

Monitoring cash inflows and discharges, managing working funding effectively, and guaranteeing Get More Info adequate liquidity are vital for the daily procedures and lasting viability of a firm. By determining financial threats such as market volatility, credit score dangers, or governing modifications, firms can proactively implement steps to secure their financial stability.

Additionally, economic coverage and analysis play a vital role in calculated decision-making. By creating precise monetary reports and carrying out extensive evaluation, organizations can acquire useful insights right into their monetary performance, identify areas for renovation, and make informed calculated choices that drive lasting development and success.

Growth and Expansion Techniques

To move a company in the direction of raised market presence and success, tactical growth and expansion methods have to be diligently devised and implemented. One reliable approach for development is diversity, where a company enters brand-new markets or deals brand-new products or services to reduce dangers and capitalize on emerging opportunities. It is vital for companies to conduct extensive market research study, financial evaluation, and threat analyses prior to getting started on any kind of development technique to guarantee sustainability and success.

Final Thought

To conclude, navigating the intricacies of company formation requires careful consideration of company framework, lawful compliance, tax obligation planning, monetary monitoring, and development techniques. By strategically choosing the ideal organization framework, making certain lawful compliance, intending for taxes, managing financial resources efficiently, and executing growth methods, business can establish themselves up for success in the affordable company environment. It is essential for organizations to come close to firm formation with a calculated and detailed mindset to accomplish long-lasting success.

In the world of company formation, the essential choice of choosing the appropriate company framework lays the foundation for the entity's lawful and functional framework. Business owners have to thoroughly assess the offered options, such as single why not try this out proprietorship, partnership, limited obligation business (LLC), or corporation, to determine the most appropriate framework that straightens with their business goals and scenarios.

By creating detailed budget plans that align with the business's purposes and objectives, companies can designate resources efficiently and track performance versus financial targets.

In conclusion, navigating the intricacies of firm formation calls for careful consideration of organization structure, lawful compliance, tax planning, financial administration, and development approaches. By tactically picking the best organization structure, making certain lawful compliance, preparing for tax obligations, handling funds effectively, and carrying out growth methods, firms can set themselves up for success in the competitive business atmosphere.

Report this page